Identity thieves and scammers will do just about anything to get your money. There are all kinds of schemes—some more clever than others—that can deceive you and convince you to hand over your money. In this day and age, it can be easy for someone to digitally rob you, and credit card scams are an especially notorious and menacing method.

In the last few years, several large corporations have fallen prey to credit card scams through payment processing system breaches, which release the valuable credit card information of thousands of customers. Read on to learn how to identify and protect yourself from credit card scams.

1. Enroll in Fraud Alerts

Many credit cards are smartening up to the tactics of identity thieves and hackers. Make sure your credit card company has a fraud department with alert notifications set up. These programs work by alerting you every time suspicious activity on your card appears. This might be activity from a different state or a different country, or possibly just a purchase that you wouldn’t regularly make. These suspicious purchases are frozen until you personally respond to the fraud alert. In this way, you can prevent a potential credit card scam before it even begins.

2. Beware of Calls or Emails Requesting Financial Information

Sometimes, the county or the government may contact you requesting information due to a missed jury duty appointment or an issue with your taxes. These summons are very important and require prompt delivery with the threat of hefty fines or even jail time. Money scammers have been known to use this sort of threatening presence and authority to request your financial information under the guise of a governmental agency. Don’t give anyone your account information over the phone or by email until you’ve confirmed the legitimacy of the source. If there’s even the slightest doubt in your mind, don’t give out your credit card numbers.

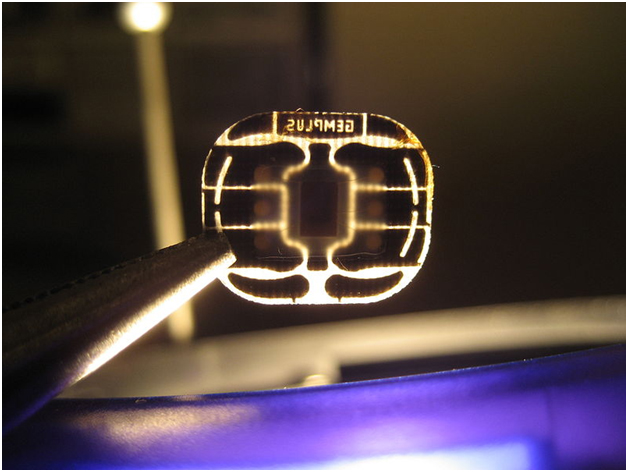

3. Understand Chip Cards

EMV chip cards are one of the newest credit card innovations. However, as with all innovations, this one opens the doors for fraudsters to take advantage. Scammers may send out an email asking you to provide them with your card numbers or account information in order to issue you a new card. In reality, they’re just going to use your card numbers to make purchases for themselves. If you own a chip card, be especially careful to follow up concerning email card notifications.

4. Phony Debt Settlement or Consolidation

A huge percentage of Americans are saddled with debt, whether from a house mortgage, car payments, or college loans. Scammers know that many people are desperate to pay off their debt by foregoing easy-to-manage chunks. One popular form of debt consolidation scams includes a promise to handle your debt in exchange for a one-time payment. Many of these offers sound too good to be true, and that’s because they are.

To be sure, there are real and helpful ways to handle your debt out there, including credit card negotiation—a process of contacting your creditors and requesting to settle for a lower total balance or a decreased interest rate. Although settling your debt can be intimidating, the right debt settlement company can realistically walk you through legal and efficient processes to help you get in control of your financial life. By contrast, a fraudulent “debt settlement” company is out to prey on desperate people lured in by the promise of debt-free living.

5. Dangerous Email Link Scams

If you skim through your spam folder, you’ll probably find hundreds of these link-activated credit card phishing scams. Many of them begin with a sob story or an invitation to receive a cash prize. However creative the campaign may be, the sender will eventually ask for money, with promises about how you’ll receive double or triple in the coming months.

Often, the email will provide a link that will ask for your credit card information—even clicking on this link will send a virus into your computer that will track down your credit card number. Never click on a link embedded in an email from an unknown sender.

There are hundreds of ways to get scammed with your credit card. But if you know what to look for, you can avoid these terrible frauds and find your way to legitimate financial freedom. There are secure and smart ways to learn how to handle credit card debt. Let a professional financial consultant or advisor help you avoid getting sucked into a credit card scam, educate on potential debt settlement solutions, and get you back on your feet.

Author Bio:

Frankie Little is a creditor, financial advisor, and freelance writer from Calabasas, California. With over 10 years in the financial industry, she has maintained good standing accounts on all of her clients, and has helped them to successfully attain their financial goals. When she is not busy with work, she enjoys researching about new businesses to invest in and reading.

Image Credit:

1: https://pixabay.com/static/uploads/photo/2014/09/28/10/38/road-sign-464653_960_720.jpg

2: https://static.pexels.com/photos/29781/pexels-photo-29781.jpg

3: https://commons.wikimedia.org/wiki/File:Chip_extracted_from_an_AT%26T_Mobility_SIM_Card.JPG

4:https://pixabay.com/static/uploads/photo/2015/11/06/12/46/financial-equalization-1027281_960_720.jpg

We usualy get such scam calls and emails and social media updates. we should be aware of them. You made an effective post to be cautious from such scams. Thanks mate.

Glad you like this post Nikhil. Thanks for dropping your comment. Keep Coming.

Hey,

Thanks for these awesome tips to keep yourself protected from online scams!

Besides these, I always check whether a site has SSl Certificate before I check out.

Punit

Hey Punit,

Glad you like this post. Checking SSI certificate is a good idea to do before purchasing through credit cards.

Thanks for droping your comment here. Keep coming.

Thanks for sharing great stuff..!!

Amazing tips one need to always make sure from being scammed in credit card . The tips you shared are worth remembering every time before using your credit card .

Thanks For Sharing! Nice Information

Thank you for the amazing tips for the protect yourself from online credit card scams. These tips really helpful and avoid the credit card scams.

So thank you once again for these tips to protected yourself from credit card scams..

Thanks sir for sharing important tips for protect credit card scams.